US Products for Dropshipping That Beat China Imports

When customers receive their order in just two days instead of the usual three weeks, they do not just leave a great review. They order three more items that same week.

Thousands of dropshippers now source from U.S. warehouses to avoid slow overseas shipping.

The shift toward domestic sourcing isn't just about speed. It's reshaping how customers perceive value and quality in online shopping.

It is a fact that international suppliers still dominate product variety. However, US-based products for dropshipping offer something increasingly rare. The ability to exceed customer expectations on delivery while building genuine trust through consistent, reliable fulfillment.

Why U.S.-Stocked Products are Reshaping the Dropshipping

The dropshipping world changed when customers started expecting Amazon-level delivery speeds from every online store. Waiting 2-3 weeks for a package from overseas no longer meets customer expectations.

Faster Shipping Is Not the Only Advantage

Shipping from warehouses in Ohio or California means customers receive their orders in days, not weeks. This eliminates lost tracking numbers in customs and the stress of international shipping. Customers can also reach support during business hours without dealing with time zone differences.

American shoppers associate “Ships from USA” with reliability and quality. This label acts as a trust signal in a market crowded with overseas sellers.

Domestic Suppliers are Becoming More Accessible

In the past two years, U.S.-based dropshipping infrastructure has grown significantly. Companies that once served only big retailers now offer dropshipping programs to smaller merchants.

The global dropshipping market reached $351.8 billion in 2024. Driven in part by domestic fulfillment networks expanding access to sellers.

Platforms like Shopify Collective simplify connecting with U.S.-based brands ready to dropship. Instead of spending hours on AliExpress, you can browse curated collections from established American companies. These companies understand customer service and returns.

U.S.-Stocked Products Convert Better at Premium Price Points

U.S.-stocked products often sell at higher retail prices, and customers are willing to pay more. This allows you to maintain healthy profit margins even if your cost of goods is higher.

The image above illustrates a key misconception in dropshipping. Cheaper products automatically mean higher margins.

Let’s break it down:

- Imported Case

Cost: $3

- Retail Price: $15

- Gross Margin: $8

- Sounds great—until you factor in longer shipping, higher return risk, and lower conversion rates.

- U.S.-Stocked Case

Cost: $8

- Retail Price: $25

- Gross Profit: $17 per sale

The U.S.-stocked product yields more real profit per order. Plus, it converts better because customers are willing to pay more for faster delivery and higher perceived quality.

Don’t just chase margin percentages. Focus on profit per sale and how shipping speed influences buying behavior. U.S.-stocked items let you charge premium prices, deliver faster, and build more trust—resulting in fewer refunds and higher LTV.

Because your absolute profit per order is higher with U.S.-stocked items, you can also afford to allocate a bigger budget to ads. This fuels faster scaling and outbids competitors, since each sale generates more actual dollars to reinvest.

You earn more profit with happier customers and fewer issues.

Since higher profit per order means you can invest more in advertising, it's crucial to calculate your true break-even points accurately. Learn how to optimize your ROAS and break-even calculations to maximize your ad spend efficiency.

It's Easier to Validate Demand for U.S. Products

Sourcing domestically means working with products already proven in the American market. These items have real reviews and established demand.

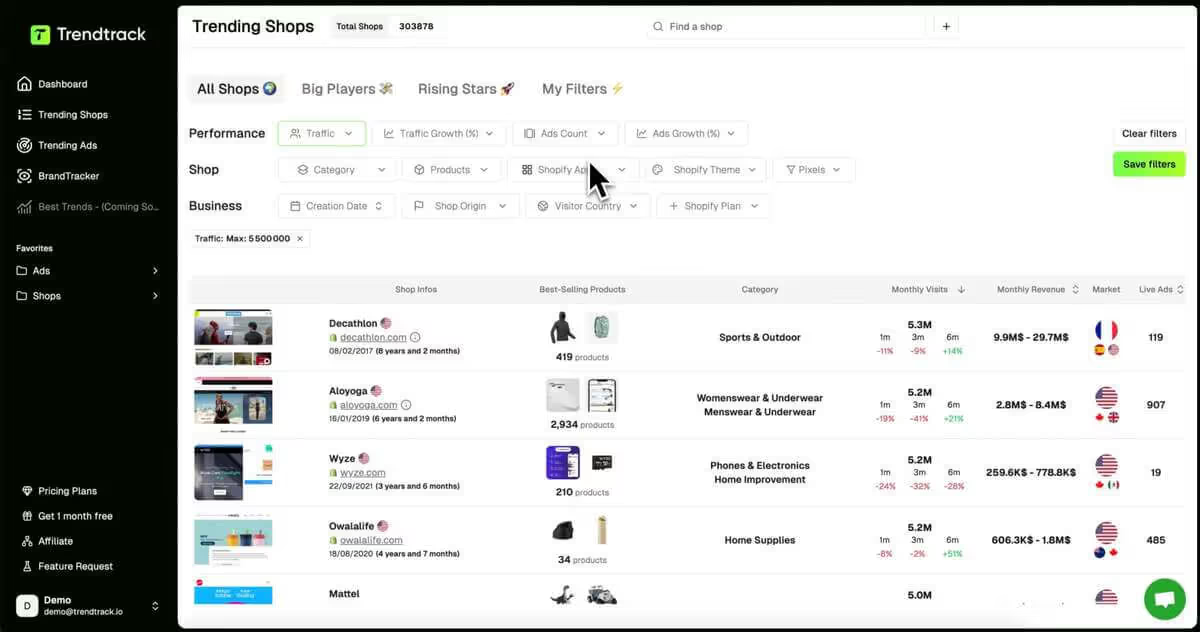

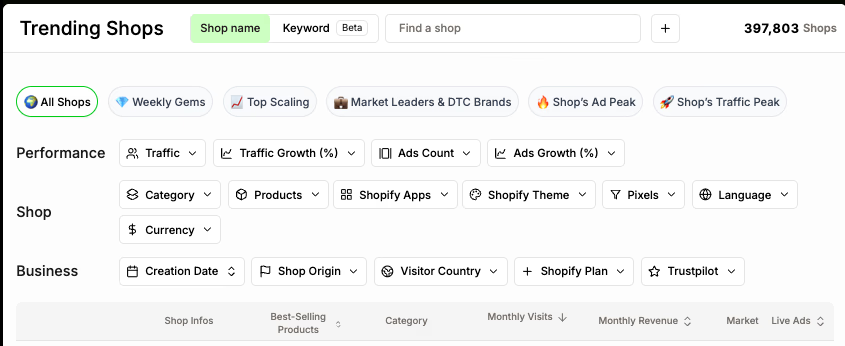

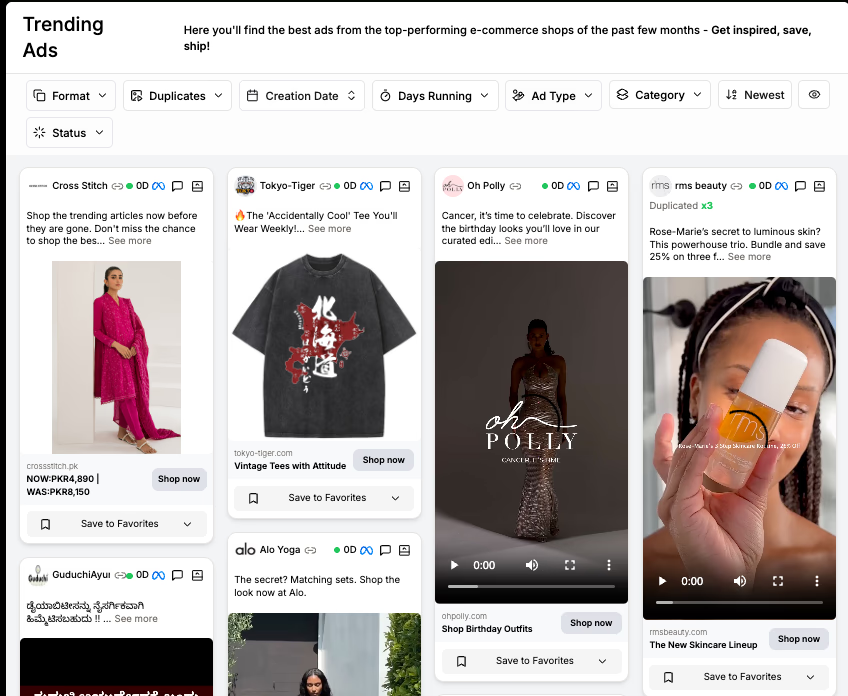

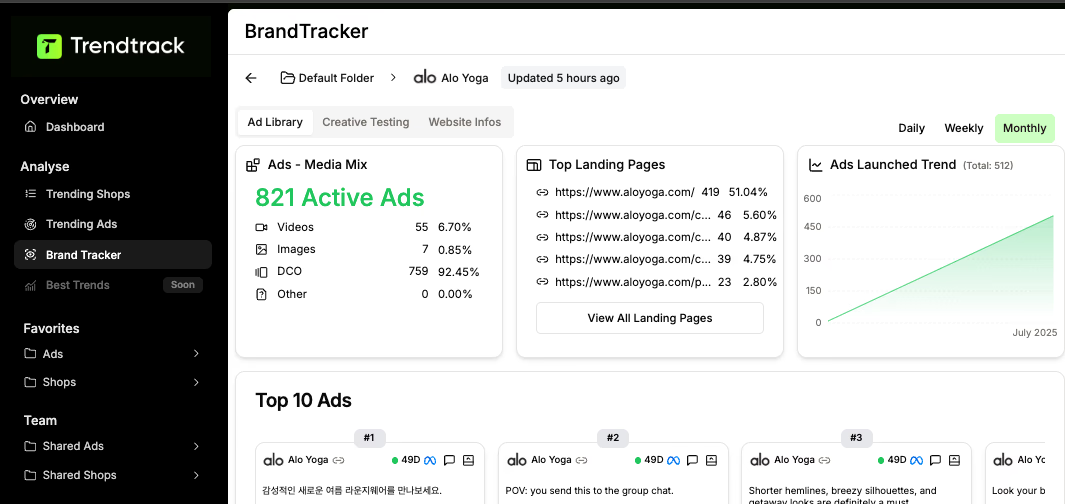

Tools like Trendtrack show which U.S.-based suppliers are growing fast. This data helps you launch with confidence, focusing on proven winners instead of guessing. You can build your strategy around real data and avoid wasting time on untested imports.

Want to fine-tune your sourcing and find trending products faster? Dive deeper into using tools like Trendtrack to reliably identify fast-growing U.S.-based suppliers for your dropshipping business.

Best Products for U.S.-Stocked Dropshipping

1. Screen Protectors and Wireless Chargers

- High urgency = high cart abandonment risk when shipping is slow. According to Baymard Institute, 18% of U.S. online shoppers abandon carts due to slow delivery expectations.

- Electronics are among the most tariff-affected categories, with rates up to 25% under current U.S.-China policies.

- Domestic sourcing eliminates delays, lost tracking, and customs issues. Despite slightly higher cost of goods, buyers accept a $10+ retail price for screen protectors that arrive in 2–3 days. Preserving 200–300% margins.

- Lightweight and small = affordable to ship nationwide.

2. Ring Lights and Phone Grips

- These are impulse-driven purchases, often driven by short-form social media content.

- Delay kills intent—if delivery takes 15+ days, the buyer either forgets or buys from a competitor with faster shipping.

- Most ring lights from U.S. suppliers retail for $20–$35, with a sourcing cost between $8–$15. Even with lower volume than Chinese suppliers, higher conversions and fewer returns increase profit per visitor.

- Margins remain healthy, especially when you avoid refund issues from faulty imports or poor tracking visibility.

3. Digital Meat Thermometers and Portable Blenders

- These products solve immediate-use problems (cooking, meal prep, gifting). If they don’t arrive before the weekend BBQ or holiday, they lose all value.

- U.S. fulfillment lets you tap into tight seasonal windows. Holidays, New Year health surges, and Mother's Day—where timing dictates success.

- Tariffs on kitchen appliances are 10–15% on average, increasing the landed cost of overseas goods.

- U.S.-stocked kitchen thermometers ($6–$12 sourcing cost) can retail for $25–35. Combine them with meat injectors or trays to build AOVs of $50–85.

4. Food Storage Containers and Stainless Steel Tumblers

- These items are often purchased during routine household improvements or lifestyle upgrades. Buyers act quickly, and delivery time shapes satisfaction.

- Glass and stainless-steel containers are heavy—but domestic fulfillment lowers the total cost of shipping vs. international air freight.

- Tumblers and containers are typically sourced at $8–$18 domestically and sell for $25–$45, often with bundles pushing AOVs higher.

- TikTok virality around emotional gifting (e.g., personalized tumblers) makes fast fulfillment part of the perceived value.

5. Poop Bags, Dental Chews, and Anxiety Toys

- Pet supplies represent sticky revenue. Customers re-purchase on a monthly cadence, and U.S. fulfillment ensures you’re available when they need it.

- Emotional urgency is strong: when a dog chews furniture or a cat refuses litter, owners won’t wait two weeks for delivery.

- Margins are high even for consumables: domestic poop bags cost $2–$3 per pack, retail for $10–$15. Supplements and calming toys priced at $25–$50 deliver over 3x markup with customer loyalty.

- U.S.-stocked bundles (harness + treats + bottle) regularly hit AOVs of $60–$80 and reduce churn with autoship incentives.

6. Teething Toys and Sleep Sacks

- Zero tolerance for delayed or questionable products. Parents are risk-averse and buy with urgency (e.g., colic relief toys or sleep aids needed this week).

- Baby products are repeat-purchase-friendly: pacifiers, swaddles, and sensory toys rotate with child growth stages.

- U.S. fulfillment reduces refund risk and elevates trust, which directly impacts reviews, referrals, and parent group recommendations.

- Organic sleep sacks sourced at $10–$18 retail easily for $35–$60 due to safety certifications and “Made in USA” trust signals.

7. Refillable Skincare Bottles and Facial Rollers

- These are small, high-margin items ideal for fast, affordable domestic shipping.

- Beauty buyers demand quality and brand trust. Customs delays, packaging damage, or unknown ingredients from overseas break confidence.

- Products like eye rollers and gua sha stones cost $3–$7 domestically and sell for $20–$30. These often paired with branded bags, kits, or bonus samples to increase perceived value.

- Tariffs on beauty tools range from 0–17% depending on classification. But domestic sourcing avoids uncertainty and ensures compliance with FDA labeling.

Skyrocket Your E-commerce Growth

Access data-driven insights to supercharge your Shopify sales and dominate your niche effortlessly.

Final Summary: The Economics of U.S. Sourcing

Product Type | Tariff Impact | Shipping Cost Risk | Emotional/Timing Value | Repeat Purchase | Price Tolerance |

|---|---|---|---|---|---|

Electronics Accessories | High | High (small delays hurt trust) | Urgent needs (charging) | Low | High |

Kitchen Tools | Medium | Moderate to High | Season/event sensitive | Moderate | High |

Pet Supplies | Medium | Low (light items) | Emotional urgency | High | Medium–High |

Baby Products | Low–Medium | High (no error tolerance) | Safety-driven urgency | High | High |

Beauty & Wellness | Low | Low (compact/light) | Perceived brand value | Moderate | High |

What you gain in conversion rate, lifetime value, and reduced churn outweighs the marginal savings of slow imports.

How Trump's Tariffs Make US Products More Competitive for Dropshippers

The trade landscape changed sharply with new tariff policies. For dropshippers who adapt, this shift offers a valuable opportunity. What began as a protectionist move has become a real advantage for merchants willing to rethink their sourcing.

Understanding the New Tariff Landscape for Imported Goods

Consider this example: You sell wireless earbuds from overseas at $25 wholesale. After tariffs, the cost rises to $32.50. Meanwhile, a competitor sources identical earbuds from a US warehouse at $30. Suddenly, the domestic option is the smarter choice.

Tariff impacts vary by product category:

- Electronics saw rates jump from 7.5% to 25% on many items.

- Home goods increased by 10-15%.

- Some beauty products faced minimal tariff changes.

This uneven impact creates opportunities where domestic sourcing makes sense for specific niches.

Some of the dropshippers are already shifting. For instance, phone accessories from overseas used to win on price. Now, a phone case from China costing $2 adds $0.50 in tariffs.

A US supplier offering the same case at $3.25 becomes more attractive, especially with faster shipping and happier customers.

Cost Advantages of Domestic Sourcing vs International Suppliers

When you calculate total costs, domestic sourcing often wins. International suppliers may offer lower base prices, but the landed cost tells a different story. Besides tariffs, slower shipping reduces conversions, return shipping costs rise, and customer service issues increase due to delays.

For example, a silicone spatula set from overseas might cost $4.50 after tariffs, while a domestic supplier charges $5.25. The $0.75 difference disappears when you consider faster delivery and fewer refund requests.

Beauty products are a special case. Many personal care items face low tariffs, but US suppliers benefit from a perception of higher quality.

American shoppers associate domestic sourcing with better safety standards, especially for skin products. This trust allows you to charge premium prices that cover any cost difference.

Long-Term Business Protection Strategies

Building your business around US-stocked products provides protection from future trade disruptions. Tariffs can change with politics, but domestic suppliers offer stability that international chains cannot match. Your margins stay steady, and you avoid frequent price adjustments.

US suppliers also offer more flexible minimum order quantities. This flexibility lets you test new products without large upfront costs. When trends emerge, you can stock them quickly through domestic channels instead of waiting weeks for overseas shipments.

The most successful dropshippers use a mix of domestic and international suppliers. This approach lets you find the best deals in every category and stay flexible as the market changes.

The key is to identify which products benefit most from US sourcing and secure those relationships before competitors do. This strategy helps you stay ahead and launch products confidently with real data.

Curious about which categories give you the biggest advantage when partnering with domestic suppliers? Explore methods for how to research trending products in our dedicated guide.

Validating US Product Demand Using Trendtrack's intelligence

Dropshippers know that gut feelings and YouTube “winning product” videos don’t work in 2025. The real profit comes from backing your product picks with hard data. Especially when you rely on US-stocked inventory, which usually means higher minimum orders and faster decisions.

Using Trending Shops Data to Identify Successful US Suppliers

Trendtrack’s trending shops feature helps you find the most successful eCommerce players. Filter for shops with steady traffic growth over the last 30 days to see which US suppliers are moving serious volume right now.

Most people make a mistake by chasing top-selling products and copying them. Instead, examine the entire shop catalog.

For example, a store might sell 10,000 wireless earbuds a month but also quietly move 2,000 phone grips at a 300% markup. These sleeper products often hold the real profit potential.

Traffic data reveals more than just what’s popular. If a shop’s visits jump from 50,000 to 200,000 monthly while ad spend stays steady, they’ve found something valuable. Cross-check their product categories to spot trends before they reach mainstream dropshipping circles.

Find Trending Products Before They Pop

Identify winning products in their early stages and be among the first to market. Our users consistently spot profitable trends before they go mainstream.

Analyzing Competitor Ad Performance for US Products

The trending ads section acts like a crystal ball—if you filter it correctly. Set it to show ads running for 7-14 days with many duplicates. This reveals which creative angles work well enough for competitors to scale but aren’t so old that the market is saturated.

Look for ads emphasizing domestic shipping. If several competitors in the same niche promote “ships from USA” or “2-day delivery,” that confirms market demand. Competitors willing to pay premium ad costs for fast shipping prove customers value it enough to pay more.

Want to track how your competitors evolve their marketing strategies over time? Learn with us!

Tracking Seasonal Trends and Demand Patterns

US consumer behavior follows patterns that international suppliers often miss. Back-to-school season isn’t just about notebooks. It also includes dorm organizers, portable chargers, and study accessories peaking in July and August.

Trendtrack’s historical data reveals these micro-seasons:

- Pet supplies spike in January due to New Year’s resolutions.

- Home organization products surge in March with spring cleaning.

- Kitchen gadgets peak in November for holiday entertaining, not just Black Friday.

US-stocked products let you act quickly on these tight seasonal windows. When you spot a trend in Trendtrack’s data, you can pivot fast because your inventory is already domestic. International suppliers can’t keep up.

Final Words

The shift toward us products for dropshipping represents more than just faster shipping times. It's about building sustainable businesses that can adapt to changing trade policies. Your store should meet rising customer expectations, and compete on quality rather than just price.

With tools like Trendtrack showing which U.S. suppliers are gaining traction in real time, dropshippers who lean into this shift early will have a real edge. As the market keeps moving toward speed, trust, and locally sourced products, those ahead of the curve won’t just keep up. They’ll lead.

Are you ready to get the insights?

From viral trends to million-dollar stores — unlock the insights behind what sells, scales, and converts. All in one place.

.avif)